✱ Conversion Play

✱ Churn Prevention Play

✱ Expansion Play

As go-to-market operators, it’s our job to create the systems and processes that make our GTM teams effective. One of those fundamental features (and one of the most fun) is building a system to identify a sales-ready lead (or CS-ready, in some cases).

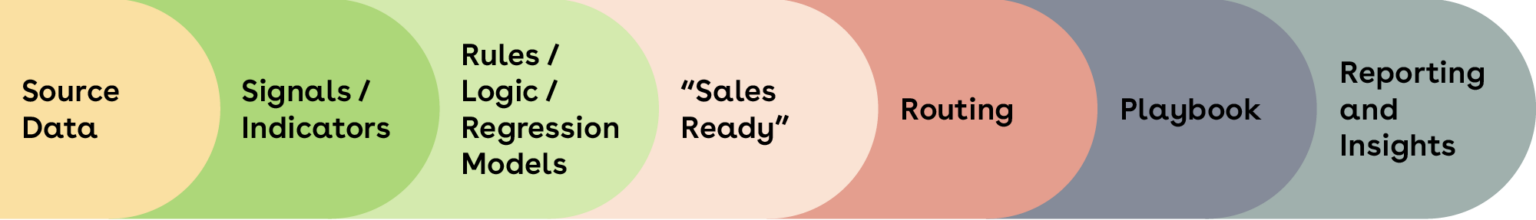

In Revenue Operations (RevOps), identifying sales-ready leads goes beyond traditional MQLs and PQLs. It’s about building a structured system that leverages source data, signals/indicators, and rules and logic to detect which prospects are ready for a human-led interaction. By integrating your ICP definition and firmographic insights, RevOps teams can create a repeatable process for prioritizing high-value opportunities, enabling sales and customer success teams to act at the right moment. This approach ensures that leads are sales-ready, qualified not only by behavior but also by alignment with your target accounts, improving conversion rates, accelerating revenue growth, and enhancing the overall customer experience.

Once leads are qualified, routing ensures they go to the correct sales or customer success representative, following a structured handoff. These processes can be documented in a playbook to standardize actions and maintain consistency across GTM teams. Finally, reporting and insights provide visibility into performance, helping teams iterate on the process, optimize conversion, and understand what drives the best outcomes for both prospects and customers.

Acronyms can get messy. Leave behind your preconceived notions of MQLs, and PQLs, and SQLs, and LMNOPs. What we want to build are the rules and processes to help our GTM teams know which of our prospects and customers need a human-led moment.

Understanding your ideal customer profile (ICP) is critical not only for lead qualification but also for designing account-based strategies. By integrating target account lists and defining buyer personas, RevOps teams can better prioritize leads that align with both short-term revenue goals and long-term customer lifetime value (CLV). Properly defining ICP ensures that every touchpoint, from marketing campaigns to sales outreach, is relevant and increases the likelihood of meaningful engagement.

For any marketers thinking about top-of-funnel lead identification, you are going to want to leverage your ICP definition in any of your logic, no matter your use case.

This is typically done with Firmographic Data.

Do not build a lead handoff process or expansion identification process without first ensuring you have all the data points (ideally normalized) to know whether you want to do business with them. (See below for examples of firmographic data.)

There is nothing that will erode your GTM team’s trust in you like sending over terrible leads. This is especially true in PLG.

Lots of people who sign up for your free trials and tiers will not convert into customers. They may have high usage, but if they are not ICPs, exclude them.

Let’s give it up for our friends at Forrester. Their research shows that data-driven organizations are 162% more likely to significantly surpass revenue goals than their data-ignoring counterparts.

That’s why we’re all going to invest in collecting and structuring our data so that it is democratized across our organization.

Source data, to us, is just the raw data points that we collect. It comes in many forms:

These are the data points that will help us understand our persona (and exclude our ICP). We may be collecting these through forms and other lead generation efforts, but more likely through third-party tools like ZoomInfo, Apollo, Clearbit, and Cognism.

This is typically first party data (you’re tracking it) showing how your prospects and customers are engaging with you. This is primarily marketing engagement, but could be with other teams. This can tell us what the individual is interested in or can infer intent.

You can think of this category as third party intent. Intent can be measured through marketing engagement or product engagement, as well. Think: G2, 6Sense, Propensity, ZoomInfo, and likely some industry specific sources.

Saved the best for last. Understanding how your users use your product is very powerful. These will be very custom to your features.

Beyond the standard firmographic and technographic data, RevOps teams should leverage behavioral analytics, engagement scoring, and cross-channel activity tracking. This allows teams to identify patterns that predict conversion likelihood or churn risk. By combining these datasets into a centralized data warehouse or CRM-integrated dashboard, teams can create a single source of truth, improving lead accuracy and enabling smarter, data-driven decision making across all GTM functions.

This is the fun part – we get to turn all the source data above into signals. Once signals are created, building automated routing rules, priority notifications, and escalation workflows ensures that leads are acted on promptly. Adding real-time dashboards and alert prioritization allows teams to respond dynamically to high-value opportunities or potential churn events. This structured alert system ensures that the right rep receives the right lead at the right time, improving conversion velocity and overall revenue efficiency.

What’s the difference between data/usage & signals? Here’s an example. Usage might be that we have 30 active users. A signal might be that active users has grown by 25% in the last 30 days.

You can also mix and match lots of different data points to come up with signals. And you should be testing these often. And don’t stop at product data.

Here are some examples

Remember, ICP is always in play.